Current Market Positions

9/10/09

Longs

. US Dollar

. QLD – Nasdaq Market

. USO – Oil

Shorts

. Financials

. Oil

. Retail

. Overall Market

. Restaurants

. Home Builders

. Commercial Property

. Commodities

. Real Estate

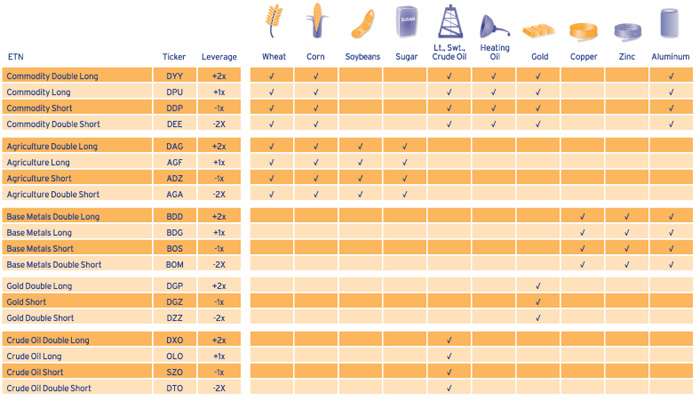

Double Long and Short ETFs

DYY (Commodity Double Long): The investment seeks to replicate, net of expenses, twice the daily performance of the Deutsche Bank Liquid Commodity Index – Optimum Yield. The index is intended to reflect changes in the market value of certain commodity futures contracts based on crude oil, heating oil, corn, wheat, gold and aluminum. The T-Bill Index is intended to approximate the returns from investing in 3-month United States Treasury bills on a rolling basis.

DEE (Commodity Double Short): The investment seeks to replicate, net of expenses, twice the inverse of the Deutsche Bank Liquid Commodity Total Return Index. The index is intended to reflect changes in the market value of certain commodity futures contracts based on crude oil, heating oil, corn, wheat, gold and aluminum. The T-Bill Index is intended to approximate the returns from investing in 3-month United States Treasury bills on a rolling basis.

DAG (Agricultural Double Long): The investment seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Deutsche Bank Liquid Commodity index – Optimum Yield Agriculture. The fund is a senior unsecured obligation that allows investors to take a leveraged view on the performance of the agriculture sector. The index is composed of roughly equal percentages of corn, wheat, soybean, and sugar futures contracts.

AGA (Agricultural Double Short): The investment seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Deutsche Bank Liquid Commodity index – Optimum Yield Agriculture. The fund is a senior unsecured obligation that allows investors to take a short or leveraged view on the performance of the agriculture sector. The index is composed of roughly equal percentages of corn, wheat, soybean, and sugar futures contracts.

BDD (Base Metals Double Long): The investment seeks to track the price and yield performance, before fees and expenses, 200% of the daily return of the Deutsche Bank Liquid Commodity index – Optimum Yield Industrial Metals Excess Return. The fund allows investors to take a leveraged view on the performance of the industrial metals sector. The index is a rules-based index composed of futures contracts on some of the most liquid and widely used base metals, aluminum, zinc and copper.

BOM (Base Metals Double Short): The investment seeks to track the price and yield performance, before fees and expenses, 200% of the inverse daily performance of the Deutsche Bank Liquid Commodity index – Optimum Yield Industrial Metals Excess Return. The fund allows investors to take a short view on the performance of the industrial metals sector. The index is a rules-based index composed of futures contracts on some of the most liquid and widely used base metals, aluminum, zinc and copper.

DGP (Gold Double Long): The investment seeks to replicate, net of expenses, twice the daily performance of the Deutsche Bank Liquid Commodity index – Optimum Yield Gold Excess Return. The index is intended to reflect changes in the market value of certain gold futures contracts and is comprised of a single unfunded gold futures contract.

DZZ (Gold Double Short): The investment seeks to replicate, net of expenses, twice the inverse of the daily performance of the Deutsche Bank Liquid Commodity index – Optimum Yield Gold Excess Return. The index is intended to reflect changes in the market value of certain gold futures contracts and is comprised of a single unfunded gold futures contract.

DXO (Crude Oil Double Long): The investment seeks to track the price and yield performance, before fees and expenses, 200% of the daily return of the Deutsche Bank Liquid Commodity index – Optimum Yield Oil Excess Return. The fund allows investors to take a leveraged view on the performance of crude oil. The index is a rules-based index composed of futures contracts on light sweet crude oil (WTI) and is intended to reflect the performance of crude oil.

DTO (Crude Oil Double Short): The investment seeks to track the price and yield performance, before fees and expenses, 200% of the inverse daily performance of the Deutsche Bank Liquid Commodity index – Optimum Yield Oil Excess Return. The fund allows investors to take a short view on the performance of the index. The index is a rules-based index composed of futures contracts on light sweet crude oil (WTI) and is intended to reflect the performance of crude oil.

Triple Long & Short ETFs

BGU (Triple Long Russell 1000): The investment seeks to replicate, net of expenses, 300% of the daily performance of the Russell 1000 Index The fund will invest at least 80% of assets in securities that comprise the index. It will also utilize financial instruments that, in combination, provide leveraged and unleveraged exposure to the index. The fund is nondiversified.

TNA (Triple Long Russell 2000): The investment seeks to replicate, net of expenses, 300% of the daily performance of the Russell 2000 Index The fund will invest at least 80% of assets in securities that comprise the index. It will also utilize financial instruments that, in combination, provide leveraged and unleveraged exposure to the index. The fund is nondiversified.

ERX (Triple Long Russell 1000 Energy): The investment seeks to replicate, net of expenses, 300% of the daily performance of the Russell 1000 Energy Index The fund will invest at least 80% of assets in securities that comprise the index. It will also utilize financial instruments that, in combination, provide leveraged and unleveraged exposure to the index. The fund is nondiversified.

FAS (Triple Long Russell 1000 Financials): The investment seeks to replicate, net of expenses, 300% of the daily performance of the Russell 1000 Financial Services Index The fund will invest at least 80% of assets in securities that comprise the index. It will also utilize financial instruments that, in combination, provide leveraged and unleveraged exposure to the index. The fund is nondiversified.

BGZ (Triple Short Russell 1000): The investment seeks to replicate, net of expenses, 300% of the inverse daily performance of the Russell 1000 Index The fund will invest at least 80% of assets in securities that comprise the index. It will also utilize financial instruments that, in combination, provide leveraged and unleveraged exposure to the index. The fund is nondiversified.

TZA (Triple Short Russell 2000): The investment seeks to replicate, net of expenses, 300% of the inverse daily performance of the Russell 2000 Index The fund will invest at least 80% of assets in securities that comprise the index. It will also utilize financial instruments that, in combination, provide leveraged and unleveraged exposure to the index. The fund is nondiversified.

ERY (Triple Short Russell 1000 Energy): The investment seeks to replicate, net of expenses, 300% of the inverse daily performance of the Russell 1000 Energy Index The fund will invest at least 80% of assets in securities that comprise the index. It will also utilize financial instruments that, in combination, provide leveraged and unleveraged exposure to the index. The fund is nondiversified.

FAZ (Triple Short Russell 1000 Financials): The investment seeks to replicate, net of expenses, 300% of the inverse daily performance of the Russell 1000 Financial Services Index The fund will invest at least 80% of assets in securities that comprise the index. It will also utilize financial instruments that, in combination, provide leveraged and unleveraged exposure to the index. The fund is nondiversified.

Leave a Reply

You must be logged in to post a comment.